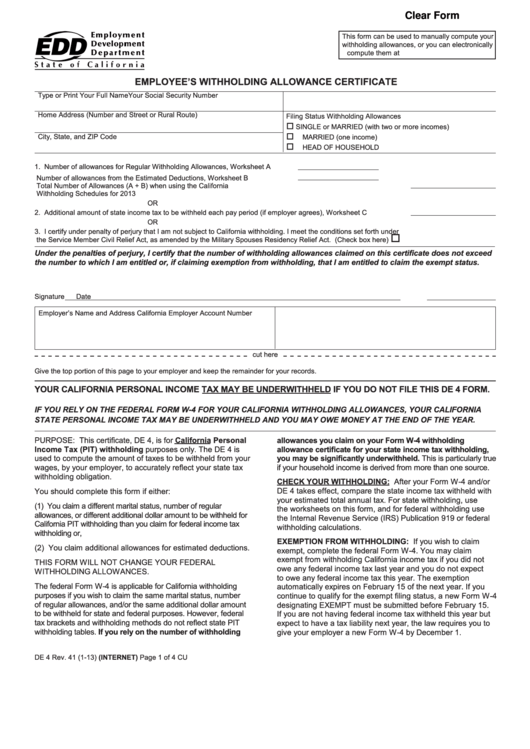

Ca Withholding Form 2025. The ca tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.). However, most financial firms will automatically withhold 10 percent of the amount withheld for.

The deadline to file a california state tax return is april 15, 2025, which is also the deadline for federal tax. To 10:00 p.m., pacific time, due to scheduled maintenance.

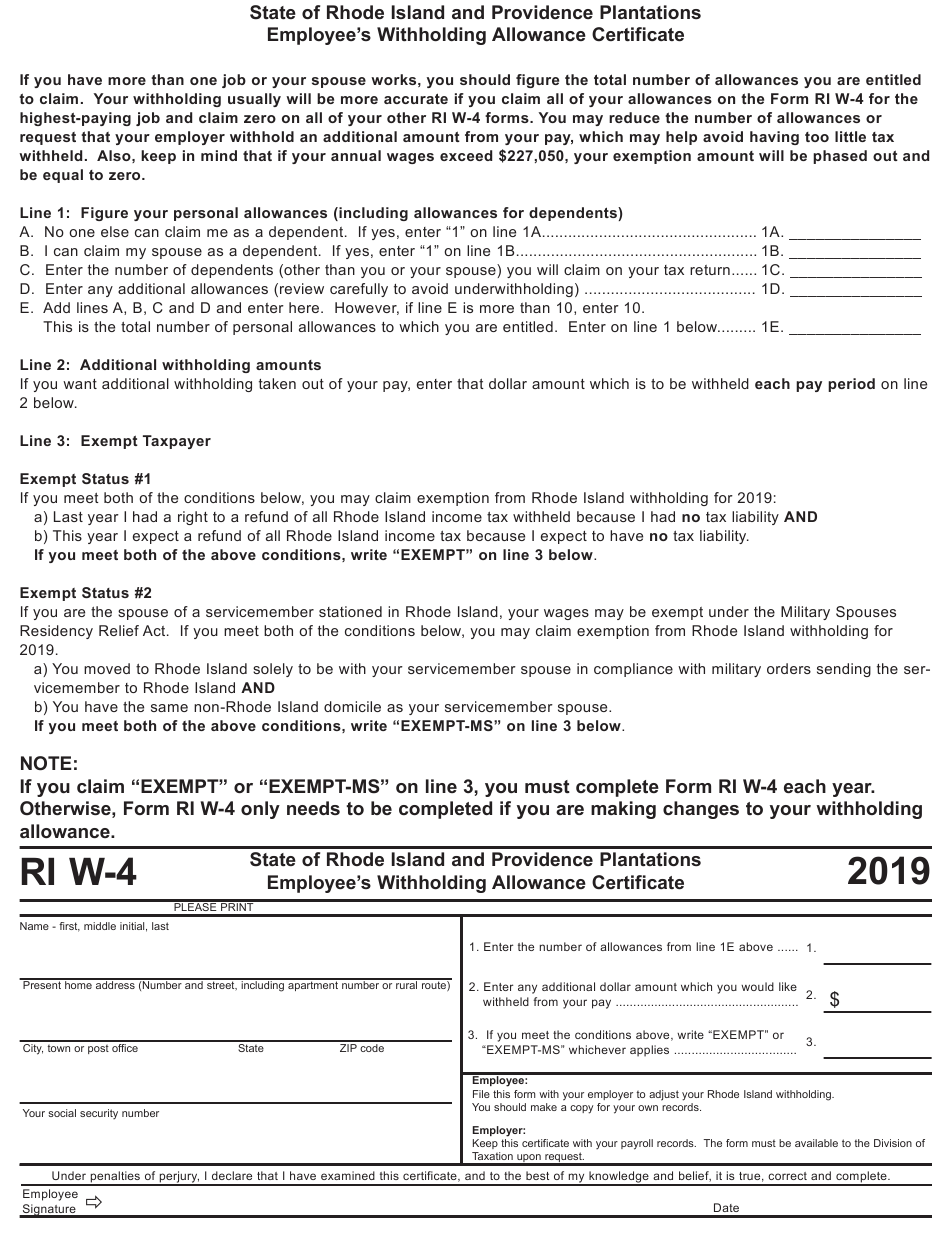

California State Withholding Form 2025, The california tax calculator is updated for the 2025/25 tax year. In california, a law signed in 2025 takes effect on january 1, 2025, which eliminates the taxable wage limit on employee wages subject to california’s state.

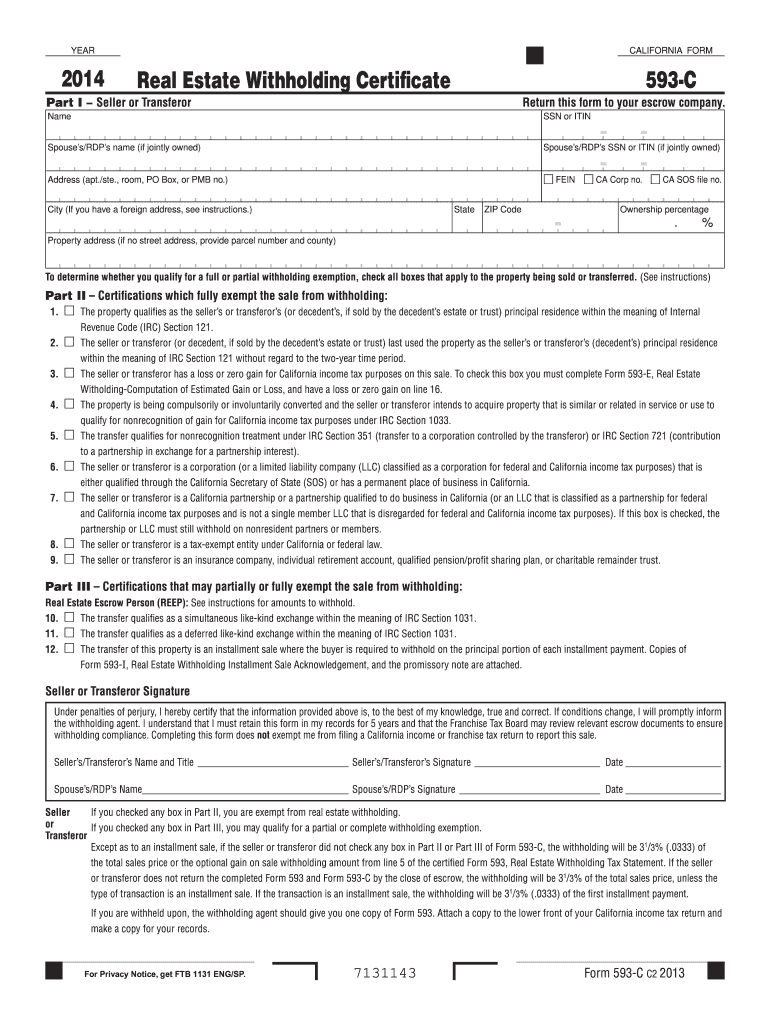

593c 2025 Fill out & sign online DocHub, California’s withholding methods will be updated for 2025, an official from the state employment development department said oct. Effective january 1, 2025, senate bill (sb) 951 removes the taxable wage limit.

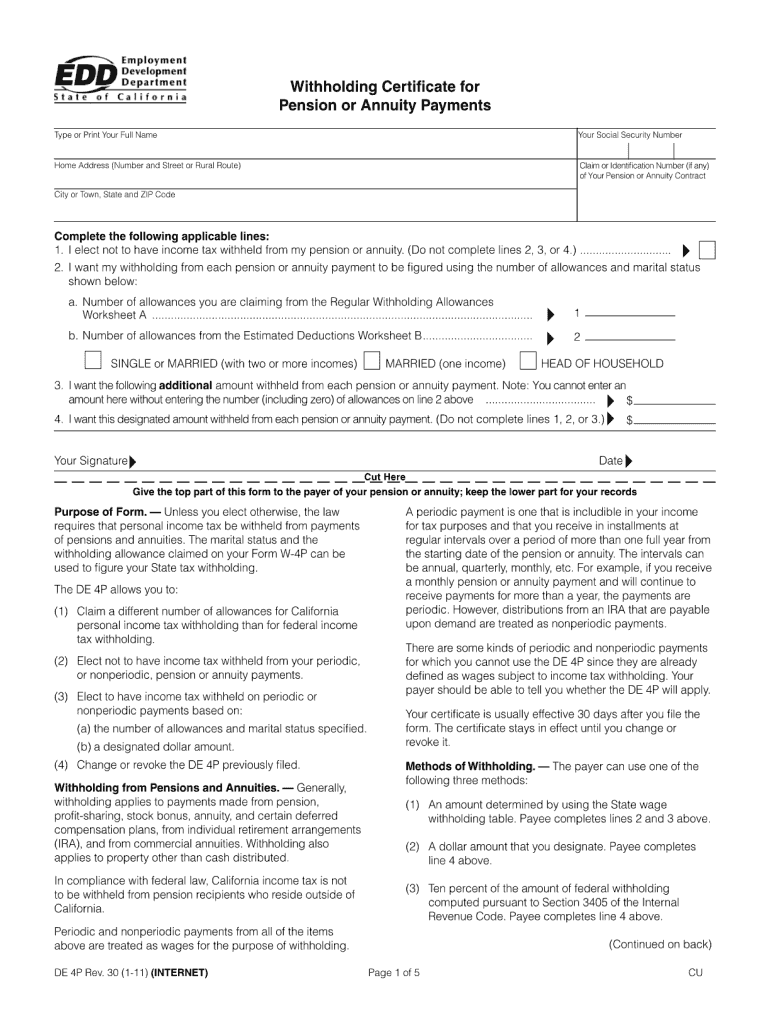

2011 Form CA EDD DE 4P Fill Online, Printable, Fillable, Blank pdfFiller, Paylocity updated standard deduction and allowance values for the effective date of january 1, 2025. Effective january 1, 2025, senate bill (sb) 951 removes the taxable wage limit.

Form W4 (Employee's Withholding Certificate) template, The edd form de 4 lets employees claim withholding allowances according to their filing status, number of dependents, and deductions. Do i need to fill out a de 4?

W 4 Employee Withholding Certificate 2025 IMAGESEE, The 2025 tax rates and thresholds for both the california state tax tables and federal tax tables are comprehensively integrated into the california tax calculator for 2025. What is the deadline for filing california state taxes in 2025?

Federal Withholding Tables 2025 Federal Tax, The deadline to file a california state tax return is april 15, 2025, which is also the deadline for federal tax. Withholding from an ira distribution for california income taxes is not mandatory.

Fillable Employee'S Withholding Allowance Certificate Template, Tax year updating this field may cause other fields on this page to be updated and/or removed. This page contains links to federal and provincial td1 forms (personal tax credits return) for 2025.

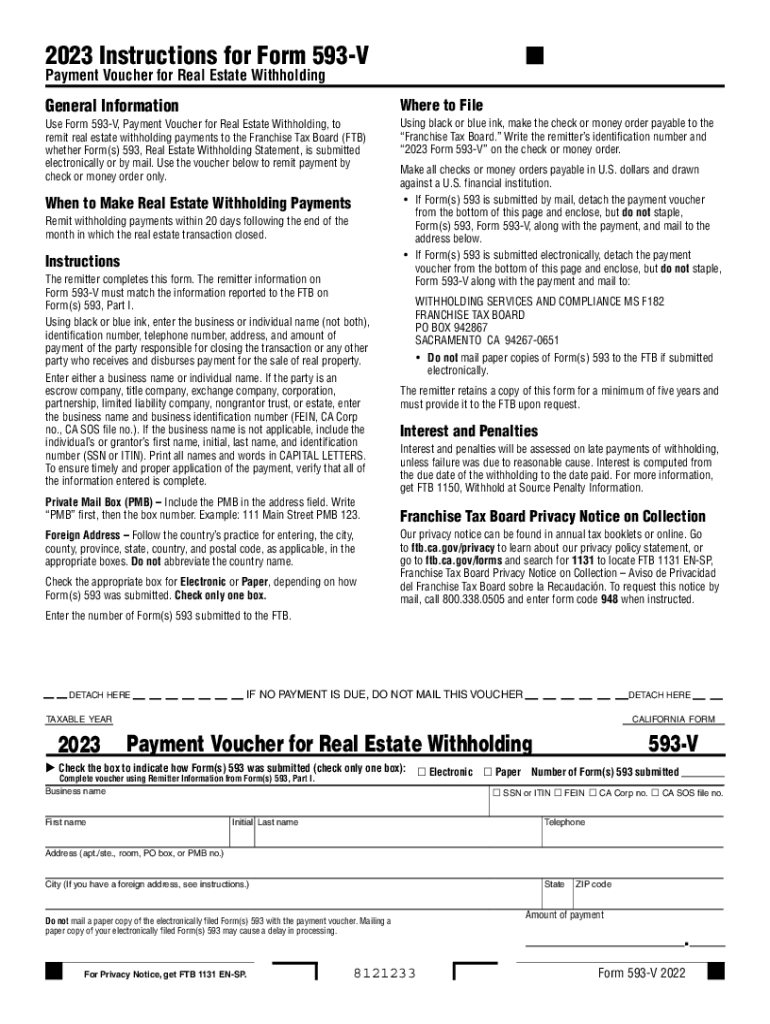

593 20232024 Form Fill Out and Sign Printable PDF Template, Do i need to fill out a de 4? In california, a law signed in 2025 takes effect on january 1, 2025, which eliminates the taxable wage limit on employee wages subject to california’s state.

20182024 Form CA CalPERS Tax Withholding Election Fill Online, The edd form de 4 lets employees claim withholding allowances according to their filing status, number of dependents, and deductions. Credit card services may experience short delays in service on wednesday, may 1, from 7:00 p.m.

Withholding Allowances, Your employer is required to report wage and salary information on the wage and tax. Paylocity updated standard deduction and allowance values for the effective date of january 1, 2025.

The de 4 form, or employee’s withholding allowance certificate, is used by california employees to determine the number of withholding allowances they claim for.

Top 10 Comedy Series 2025. Sterlin harjo and taika waititi’s groundbreaking series reservation dogs has […]